Let’s get one thing clear: ChatGPT isn’t here to replace accountants, it’s here to help them work smarter.

By offloading repetitive admin and everyday communication, accounting GPT tools can handle tasks like drafting emails, summarising financial reports, or even generating client-ready tax insights. This gives professionals more time to focus on what really matters such as client strategy, compliance, and business growth.

Whether you’re offering outsourced bookkeeping services, tax support, or end-to-end advisory, using ChatGPT for accounting can enhance accuracy and turnaround times, without increasing overhead.

Simplify Client Communication

One of the most immediate benefits of using ChatGPT for accountants is its ability to simplify day-to-day communication. Whether it’s creating routine emails, client reminders, or even marketing content, ChatGPT accounting can help you save time and improve clarity.

While some modern bookkeeping AI tools are now integrating with GPT-powered features, you can start exploring this technology for free by setting up a basic OpenAI account. Within seconds, you’ll be ready to generate emails that are clear, professional, and customised to your firm’s voice.

If your firm offers client advisory or compliance services, using AI-generated email drafts can significantly cut down admin work, allowing you to spend more time on client-focused services and strategic planning.

Tips for Writing Better Emails with ChatGPT

1. Set the Scene

Context is everything. When using Chat GPT for accounting, begin by telling the model exactly who you are and what you want. For example:

“Before you generate the email, here’s some context. I’m a CPA at a mid-sized tax advisory firm. The email is for a prospective client, and I’d like the tone to be warm, clear, and professional.”

2. Be Specific

The more details you provide, the more accurate the output. Try prompts like this:

“Write an email to Jordan, a new client who recently signed up for our bookkeeping services. Let her know it’s time to schedule her first monthly financial review. Also, congratulate her on opening her second location and mention I’m excited to collaborate.”

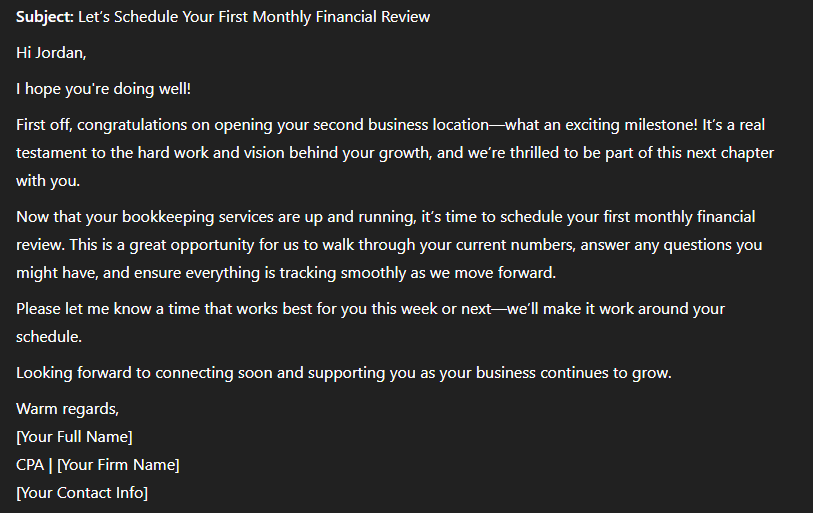

Prompt:

You are a CPA at a mid-sized tax advisory firm. Write a warm, clear, and professional email to Jordan, a new client who recently signed up for your bookkeeping services. In the email:

- Let her know it’s time to schedule her first monthly financial review.

- Congratulate her on opening her second business location.

- Express that you’re excited to collaborate with her moving forward.

- Ensure the tone is approachable and client-focused, while maintaining professionalism.

By combining the strengths of artificial intelligence in accounting with personalised client communication, you can improve efficiency without losing the human touch, something every modern accounting firm values.

Use AI Responsibly: Always Review Outputs

Even with powerful tools like ChatGPT for accounting, it’s essential to:

- Review for tone, accuracy, and firm alignment

- Always proofread before sending

- Ask ChatGPT to revise if needed

Summarise Email Threads with ChatGPT

Long email chains are a common frustration in any accounting practice. With ChatGPT for accountants, you can summarise threads instantly and get straight to the point.

Instead of scrolling through endless replies, just copy and paste the conversation (without sensitive info) and ask ChatGPT to summarise it.

This simple workflow shows how artificial intelligence in accounting can streamline your day-to-day tasks, helping you stay focused on more strategic work, rather than your inbox.

Create Marketing Strategies & Content Fast

Marketing often takes a back seat for busy accountants, but it doesn’t have to. With ChatGPT for accountants, generating high-impact marketing strategies and content takes minutes, not hours.

Thanks to GPT-4’s advanced capabilities (or GPT-3.5 Turbo, if you’re using the free version), ChatGPT can understand your firm’s goals and audience, helping you build a tailored plan across:

- Marketing strategy frameworks

- Ideal client profiles (buyer personas)

- Social media campaigns and calendars

- Blog articles and newsletter content

- Email marketing and promotional copy

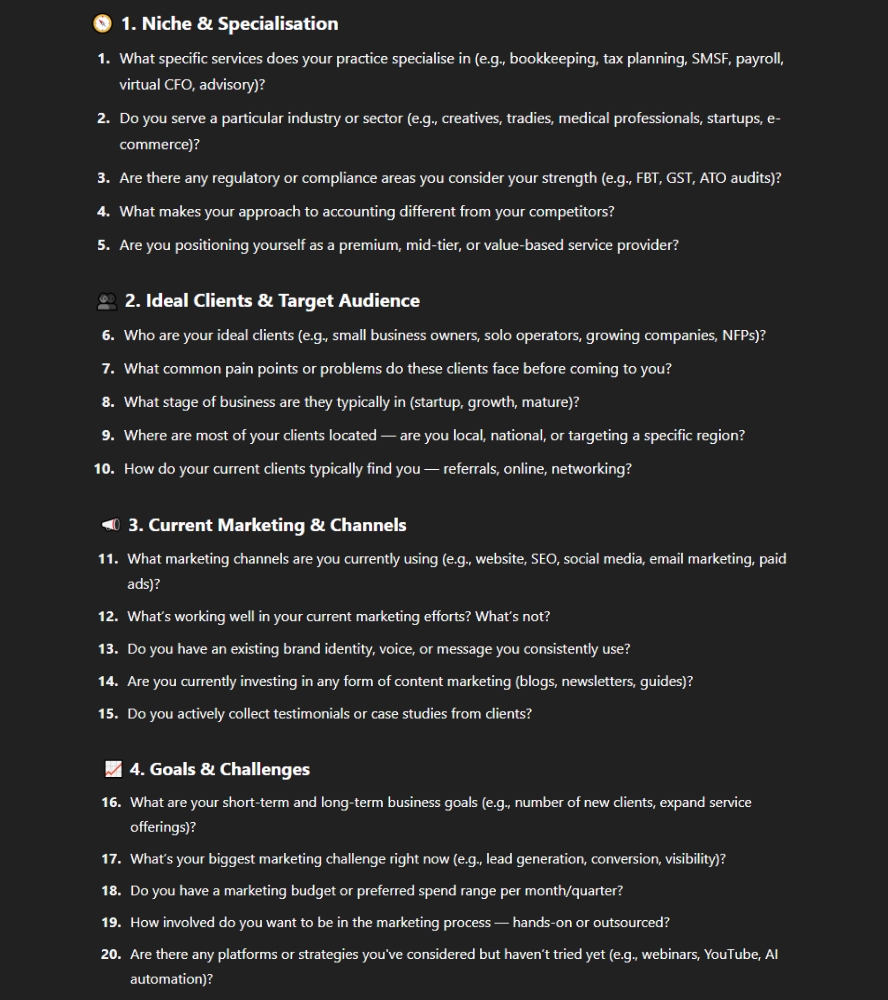

Prompt:

I’d like your help in developing a targeted marketing plan for my accounting practice. But before generating suggestions, please ask me 20 specific and insightful questions to better understand:

- My niche and specialisation within accounting

- My ideal clients and target audience

- My current marketing efforts, channels, and challenges

Your questions should be strategic and aimed at helping you craft a highly tailored, effective marketing plan that aligns with my business goals and market positioning.

By using artificial intelligence in accounting not just for workflow, but for visibility too, you can stay competitive, attract new clients, and build your brand with ease.

RELATED: Shortage Accountants in Canada

Boost Data Efficiency with ChatGPT

If you’re constantly wrangling client data from multiple sources, ChatGPT can serve as a surprisingly helpful assistant. Think of it as a fast, flexible tool to clean up and reformat information ideal for accountants and bookkeepers who want to save time on repetitive data tasks.

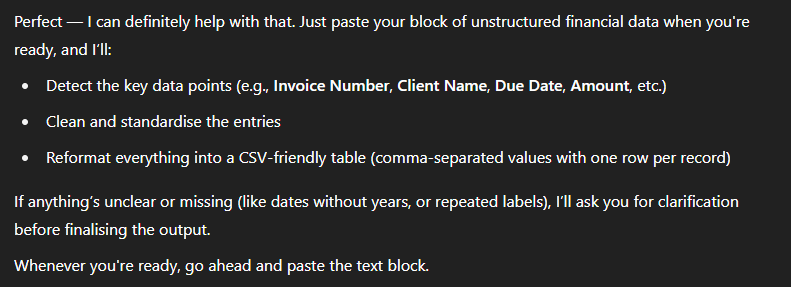

Prompt:

I’m an accountant regularly working with unstructured financial data from multiple sources. I want your help in cleaning and reformatting this data efficiently. I’ll paste a block of unstructured text (e.g., copied from emails, PDFs, or spreadsheets). Your task is to:

- Identify key data fields (like invoice number, due date, client name, balance, etc.)

- Organise the data into a clear, tabular format

- Output it in a structure that’s CSV-friendly, using commas to separate values and new lines for each record

- Ask any clarifying questions if the data seems inconsistent or incomplete

Be fast, accurate, and flexible, this is to save time on repetitive cleanup tasks.

While ChatGPT doesn’t yet support direct PDF uploads, you can use ChatPDF, a tool powered by AI in accounting to analyse and extract content from PDF files.

Pro tip: Don’t forget to review the AI-generated output for accuracy. Even the smartest bookkeeping AI needs a human to ensure everything’s correct before it’s used in client work or reports.

Extract Bank Transactions with ChatGPT

One of the most practical examples of ChatGPT for accountants came from AICPA & CIMA Engage 2023, where experts like Jason Staats showcased real-world automations including extracting transactions from bank statements using accounting GPT tools.

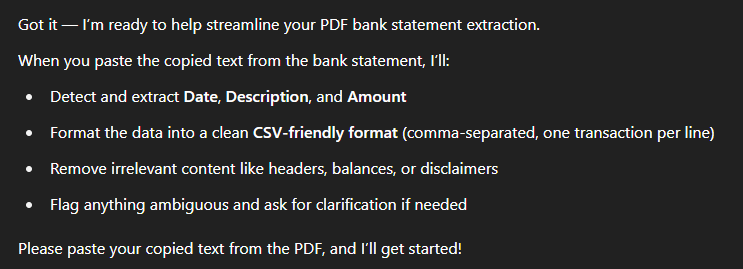

Prompt:

I’m an accountant looking to automate transaction extraction from PDF bank statements. I will paste copied text from a bank statement into this chat. Your task is to:

- Extract the transaction date, description, and amount

- Organise the data into a clean, structured table format

- Ensure the output is CSV-friendly, with commas separating values and each transaction on a new line

- Ignore any non-transactional text (headers, footers, disclaimers, etc.)

- Ask clarifying questions if any data seems unclear or inconsistently formatted

This is to streamline data entry for import into Excel or accounting software.

This method isn’t perfect, you’ll still need to review the data for accuracy, but it’s a great example of how bookkeeping AI can drastically reduce manual work.

Pro tip: Try experimenting with different prompt formats for better results, especially if your bank statements vary in structure.

Categorise Uncategorised Transactions Using ChatGPT

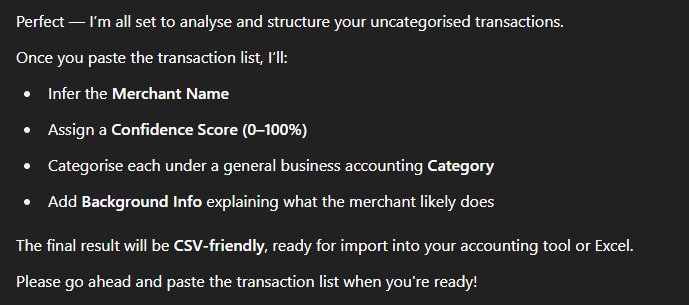

Another powerful use of ChatGPT for accountants, shared by Jason Staats and Chad Davis, is helping with transaction categorisation, a time-consuming but critical part of bookkeeping.

Prompt:

I have a list of uncategorised bank transactions that I’ll paste below. Your task is to analyse each transaction and output a structured table with the following columns:

- Merchant Name – Your best guess at the transaction’s source based on the description

- Confidence Score – A percentage (0–100%) indicating how confident you are in your guess

- Category – A general business accounting category (e.g., travel, office supplies, software, meals)

- Background Info – A brief description of what the merchant does or is known for

If a transaction description is vague or unclear, make your best inference and note any assumptions. Format the output as a CSV-friendly table for easy import.

This is a great example of how bookkeeping AI can save hours on manual classification, especially during peak reconciliation periods.

Use Case Tip: Always review and validate AI-categorised transactions to ensure accuracy but this method can drastically speed up your workflow and help standardise classifications across clients.

How Not to Use ChatGPT in Accounting

While ChatGPT accounting tools and other artificial intelligence in accounting are changing how we work, they’re not without limits or risks. There are important limits to keep in mind:

- Never input sensitive or confidential client information into ChatGPT.

- Avoid sharing proprietary business data, AI tools can’t distinguish between private and public content.

- Always proofread and verify any output before using it in your accounting work.

- Don’t rely on ChatGPT’s responses for compliance-critical decisions.

- Use AI to support, not replace, your professional judgment.

- Be aware of privacy laws and regulatory risks when using AI tools in bookkeeping.

- Remember, you are responsible for the accuracy and reliability of any work AI helps you produce.

Conclusion

As we’ve explored, ChatGPT accounting prompts can be a game changer for accountants and bookkeepers looking to save time, improve accuracy, and streamline operations. From summarising email threads to categorising uncategorised transactions and generating marketing content, the use cases for artificial intelligence in accounting are growing by the day.

But like any powerful tool, it delivers best when paired with the right approach. With a clear understanding of your goals and access to the right guidance, it’s possible to transform and streamline your bookkeeping workflows. Whether you’re optimising existing workflows or looking to innovate, there’s no better moment to step into the future of accounting.

Whether you’re curious about how to use ChatGPT for accounting or looking to completely transform your back-office tasks, now’s the perfect time to test what AI can do for your accounting practice.

More firms are now exploring outsourced bookkeeping options to manage routine tasks while freeing up internal resources for strategic growth.